How to cut your global logistics costs with tariff quotas

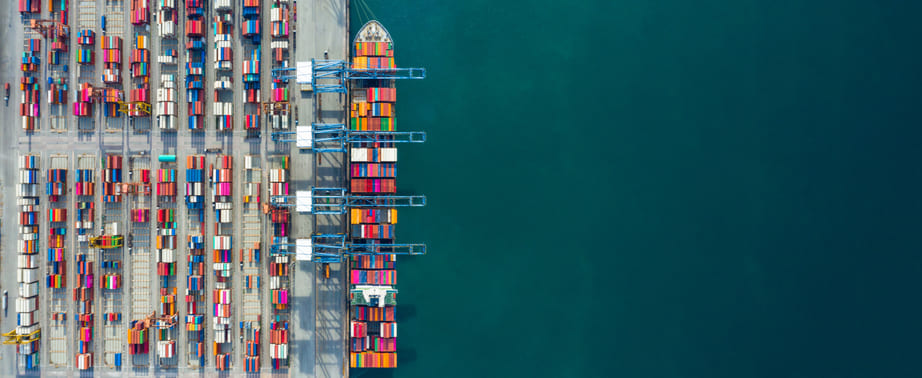

Global logistics involves coordinating an international supply chain, to deliver your beverages from their origin to the point of consumption. Within that, tariff quotas can play an important part of the international logistics process and can help keep your costs down.

In this article, we will delve into the intricate relationship between tariff quotas and global logistics, exploring the ways in which these measures affect supply chains, customs procedures, market competitiveness, and trade relationships. By understanding the impact of tariff quotas on global logistics, businesses can optimize their strategies in an increasingly complex international trade environment.

What is global logistics?

Global logistics includes the coordination of all of the activities involved in shipping goods (such as wine) from one country to another. It’s a term that umbrellas what’s involved with moving something across an international border and the information sharing and organization that comes with it. Done well, global logistics means the timely and efficient distribution of wine shipments from producers to consumers.

Global logistics encompasses everything from demand forecasting to delivery, including transportation, warehousing, inventory management, packaging, customs clearance, documentation, and distribution. Effective global logistics is therefore crucial for allowing wine businesses to navigate the complexities of international trade, reach global markets, meet customer demands, and maximise operational efficiency.

As a freight forwarder, Hillebrand Gori carefully coordinates the entire process. This includes giving advice on shipment planning, transport management and customs. Freight forwarders also manage all the parties involved, instructing carriers to when and where to move the shipment.

What are tariff quotas in global logistics?

Sometimes known as tariff-rate quotas or preferential tariff quotas, tariff quotas allow the importation of a certain amount of wine at a lower rate of duty than usual. They apply to certain products imported from particular countries.

Tariff quotas are agreed by the trade policy of a country or territory, and combine tariffs (customs duties) and quotas (import restrictions). For example, tariff quotas for EU wine imports are established by the European Commission (EC) and once exhausted, goods can continue to be imported at the normal rate of duty. It’s important to be aware of what the status of the quota you want to apply for is, as eligibility for the reduced rate ends once the quota is used up.

How do I know if a tariff quota applies to my wine shipment?

Navigating customs duties, tariffs and taxes can be confusing. Often, you will need to know the commodity code for your beverage used by the country you want to import to. Here are a few steps you can take to find out if a tariff quota applies to your shipment:

- Research the Import Regulations: Look for information on tariff quotas specific to the wine industry. The country's customs authority, trade ministry, or relevant government agencies' websites are valuable sources of information.

- Contact Trade Associations and Chambers of Commerce: They may have valuable resources, guidance, or contacts that can assist you in understanding tariff quotas and their application to wine shipments.

- Check Tariff Schedules and Harmonized System Codes: These outline the specific tariffs and quotas for different products, including wine.

- Contact the Importing Country's Customs Authority: If you still have questions or need clarification.

Or you can consult with customs brokers or freight forwarders, such as Hillebrand Gori. We possess expertise and knowledge on import regulations, including tariff quotas, and can guide you through the process.

To benefit from the lower rate of duty, you or someone acting on your behalf needs to make a claim for the reduced rate. This is usually done on the customs import declaration when clearing customs.

This process differs slightly depending on the status of the quota. Tariff quotas are given a status, depending on how much of the quota remains. Once a quota is used up, you will have to pay the full rate of duty. Tariff quotas can be:

Open

Quotas are ‘open’ when the quota is not expected to be used up (exhausted) in the near future. It can also refer to a tariff quota that has no limit on the quantity of a particular category of goods that can be imported. This means a lower rate of duty can be given to any valid claim.

Critical

When the quota may be nearing exhaustion, the EU will declare it as ‘critical’ and can track the remaining quota until it is used. Quotas may also be labeled critical if there isn’t enough information available to base a prediction of how quickly it will be used up on. Once a quota becomes critical, you or your global logistics service provider will need to pay duty at the full rate but can code it as 'on deposit'.

When applying for a ‘critical’ quota, you must also make a claim on the quota number. For EU imports, this allows the EU to automatically look at your entry and establish if there is any quota remaining. If there is, they will refund the difference between the reduced quota duty rate and the full rate paid.

Exhausted

Quotas are ‘exhausted’ when no further goods can be imported at the lower rate of duty. All claims for exhausted quotas will be rejected. To find out if a quota is applicable to a commodity from a particular country, you can check the trade tariffs for clarification. As your global logistics provider, we will monitor the amount remaining on relevant quotas to help keep you informed about your shipment.

A case study of EU tariff quotas with South African wines

The details of applying for a quota for wine or alcoholic beverage shipments can vary for different export and import countries. A large portion of the quota work we undertake is for South African wines entering the EU market.

To use the available quota, we need a copy of the ‘preference document’ to claim the quota on import. A preference document is based on a trading agreement between the EU and an outside country e.g., South Africa. They allow you to claim preferential duty rates on goods exported from countries with an agreement with the EU.

The EUR1 form is an example of a preference document, also known as a certificate of origin. You can read more about a certificate of origin in our article on the shipping documents you should be aware of.

On import, it’s better to declare the goods on deposit, while waiting for the preference document. This makes it easier to claim the money back, than if it is paid outright. Goods declared on deposit means that the money isn’t actually taken at that point, it’s held in suspense until the quota is allocated.

The receipt of this document means the quota is still available. When we send the receipt with supporting clearance documentation to Customs, they can refund the duty to the customer.

Which countries can use tariff quotas?

Many countries offer quotas on different commodities, so staying abreast of the countries that offer them is a fundamental part of our global logistics service. Ensure the global logistics service you work with is aware of the countries that offer quotas for your wine or beverages, and the status of those quotas.

At the start of each year, wines of under a certain ABV from specific countries are given a quota by the EC. Our job is to try to save customers money by obtaining as much of this reduced duty as possible. We also record the number of liters our customers receive a reduction on and offer reports detailing the achievements.

Find out more about how we can help make your global logistics more efficient

Quotas are a small but useful aspect of clearing goods into the EU. We are up to date and knowledgeable on all aspects of import clearance, customs procedures and allowances so that our customers can receive an accurate, efficient and cost-effective service. So when you use our global logistics services, you know that you are getting the best duty rate for your imports.

How can we help your business grow?