The wine industry in 2022 from vineyard to wine rack

In 2022, the wine industry dealt with higher energy prices, inflation, and disruptions to global supply chains. The result was increased production and distribution costs which forced up the price of wine in many markets and reduced demand worldwide. In such a chaotic world, staying informed is now an essential task for successful wine importers. Read on as we take the pulse of a changing wine industry.

The wine industry in 2022

On the positive side, price rises mean the total overall value of international trade in wine has reached the highest value ever recorded, increasing from €34.4bn in 2021 to €37.6bn in 2022. However, wine exports actually declined globally by 5% to 107mhl, compared to the historic high of 112.3mhl recorded in 2021. So, what’s going on?

Let’s look at the latest wine industry facts and figures in more detail.

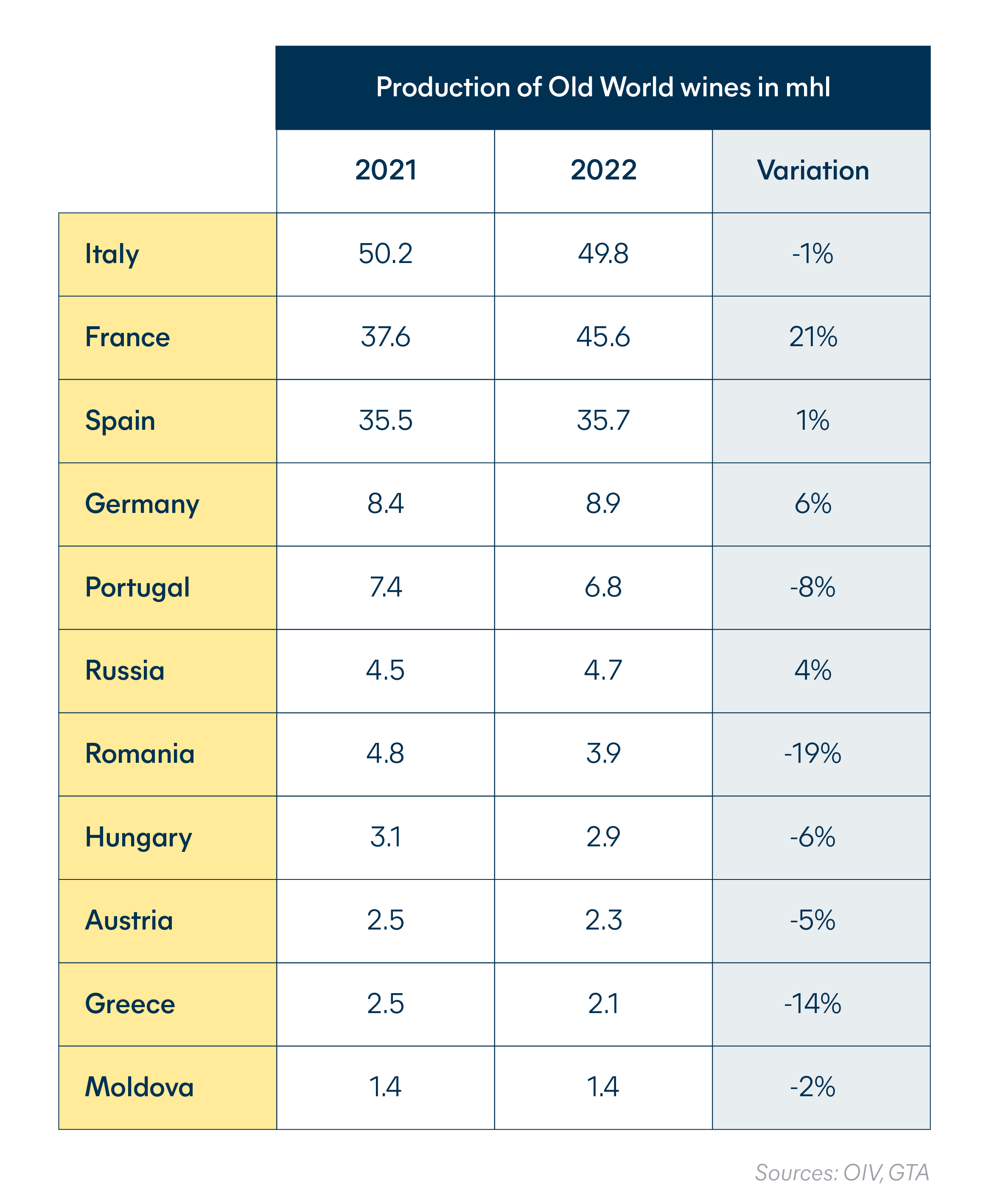

Production in Old World wine countries

The Old World EU countries of Spain, France, and Italy continue to dominate over the wine industry and still account for 51% of the world's total wine production by themselves.

For France, the last year saw a significant 21% rise in volume which also represents a 7% gain on the five-year average. Production in Spain rose just 1%, a figure that puts it 5% below its five-year average. Meanwhile, Italy saw a 1% fall in annual wine production, but a 2% increase compared to its five-year average.

Production in Germany was 6% higher but the other main Old World wine countries all saw production levels drop and in Greece, volume was at one of the lowest levels in decades.

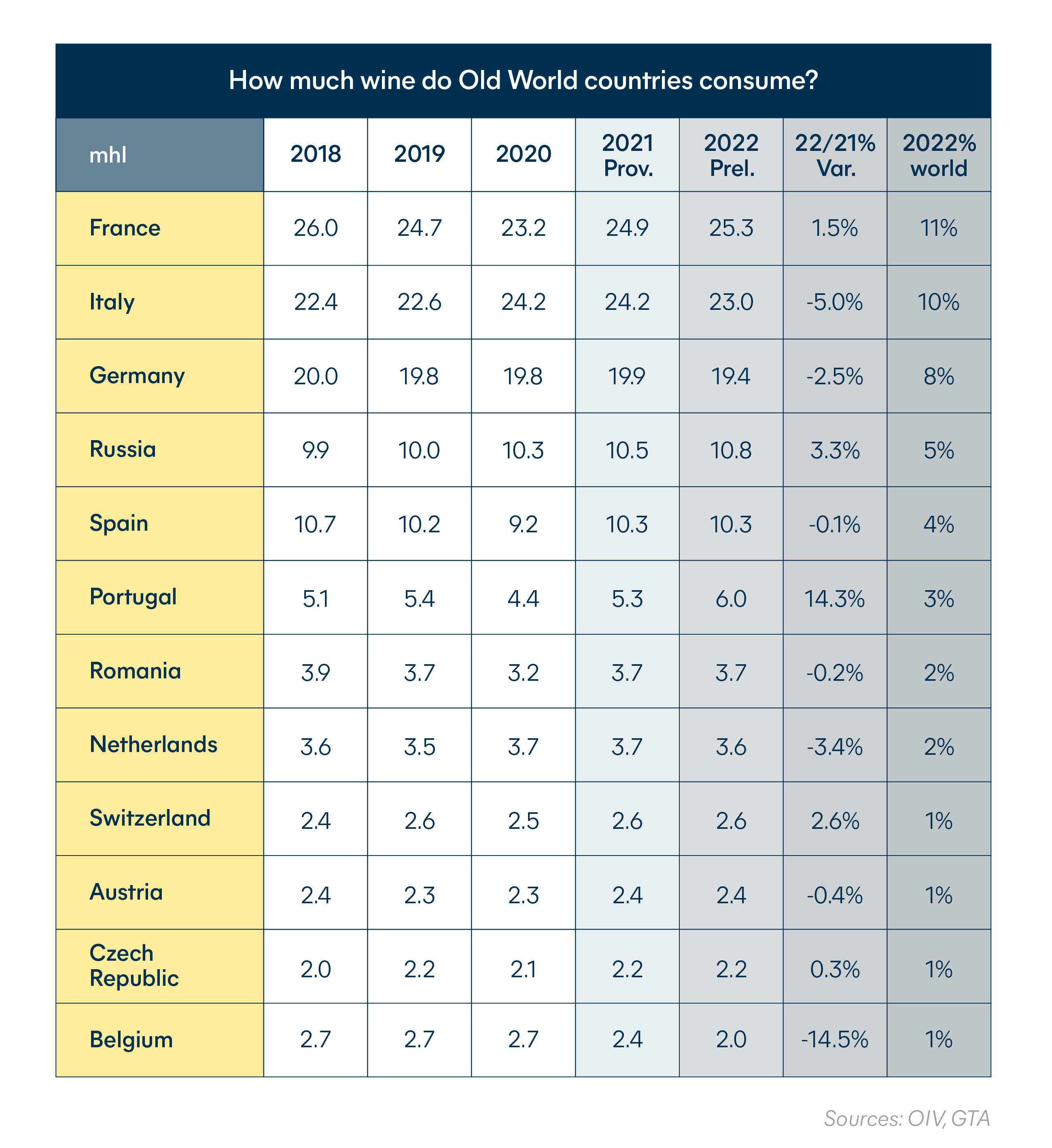

How much wine do Old World countries consume?

France takes the lead in total Old World consumption. The estimated 25.3mhl of wine bought by the French also ranked them second globally behind the US.

Demand for Old World wine over the last 5 years

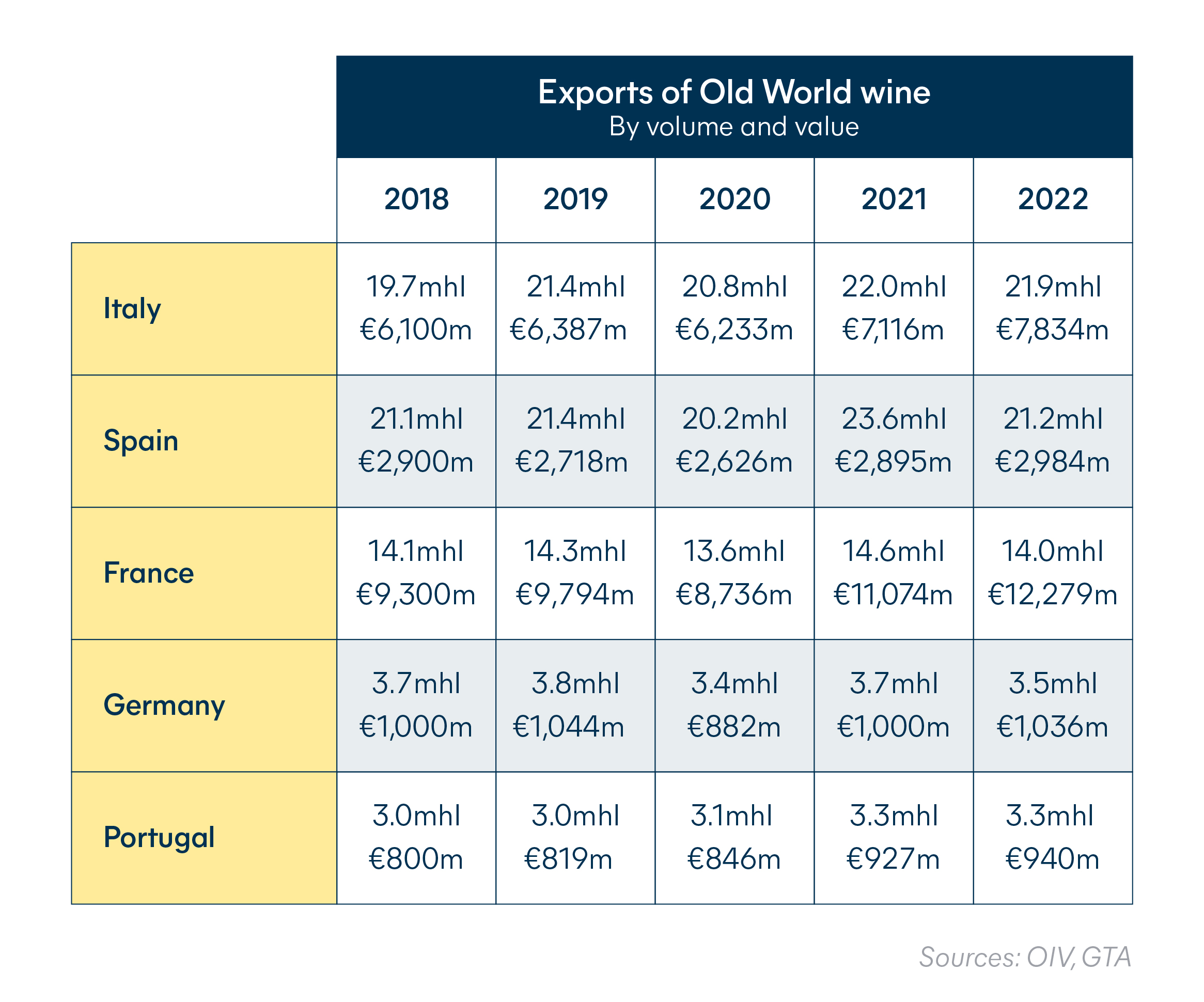

Although exports from the top three wine countries have all fallen compared to 2021, Italy, Spain, and France still accounted for 53% of world wine exports and 61% of value, exporting a total of 57mhl in 2022.

Italy came first, with exports dropping just 0.6%. Despite this, 2022 was still the country’s second-best export year in half a decade and value rose by €717m. France’s volume fell 5%, but with exports generating €12.3bn, it remains top in value, claiming almost one-third of all global export value. Spain suffered a decrease in volume of 10% and a modest 3.1% rise in value.

How much do Old World countries import?

Germany is the second largest wine importer in the world after the US. But in 2022, Germans imported 9.3% less wine by volume and value dropped to €2.7bn, a loss of 4% compared to 2021.

Globally, the UK comes in third with a volume of 13mhl imported in 2022, but imported 2% less in 2022. However, value rose sharply in all categories to reach €4.8bn. Sparkling wine in particular saw a 41% increase over 2021.

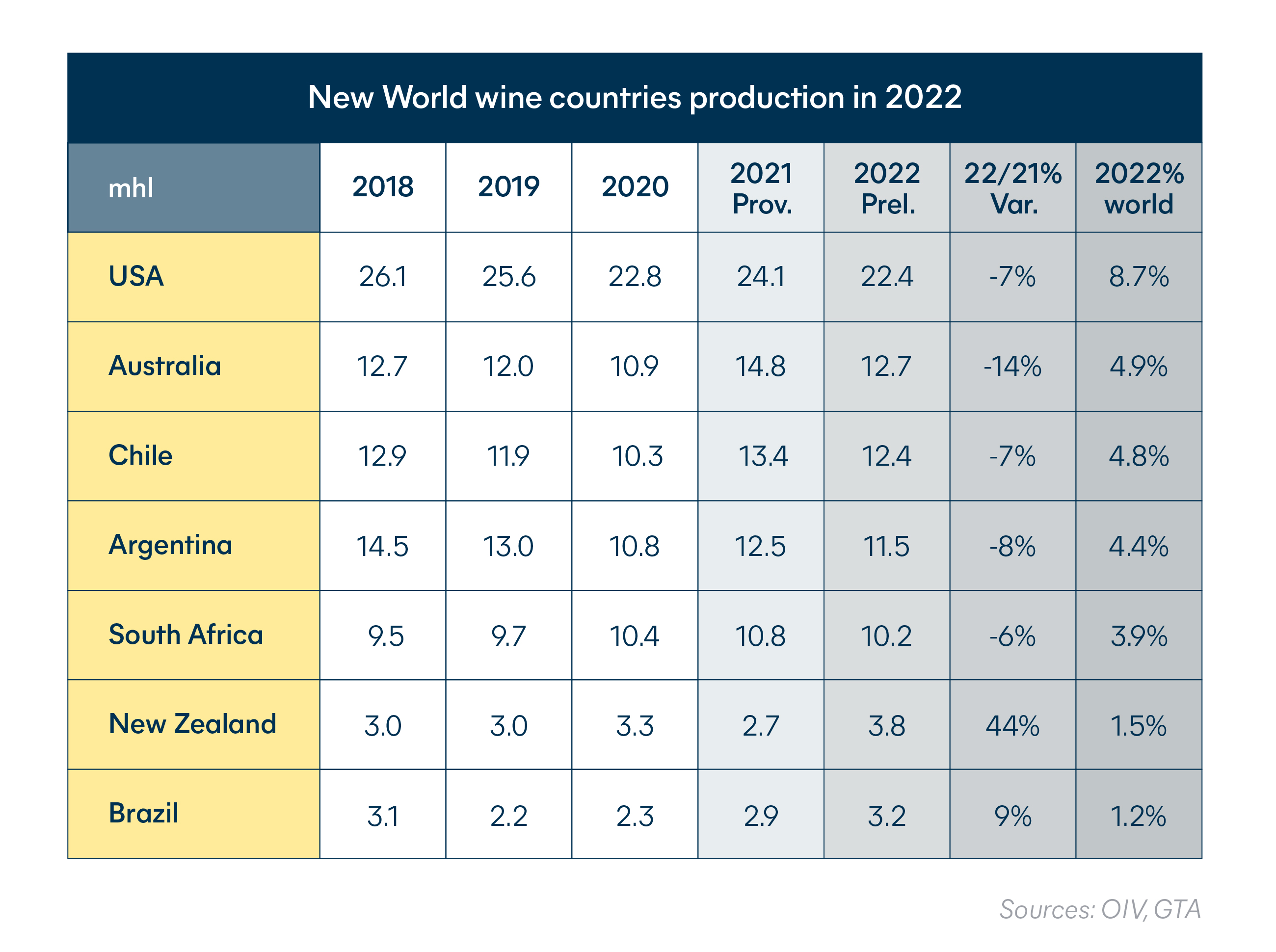

New World wine countries production in 2022

Top producer the US saw output decline 7% below the previous year and 9% below its five-year average. This trend was repeated in the two leading South American producers. Chile saw a decline of 7% and Argentina 8%. However, in Brazil, production was up 9% and 14% above the five‐year average.

In Oceania, in Australia output dropped 14%, but New Zealand enjoyed a hefty 44% surge achieving a record-high of 3.8mhl.

Exports from New World wine countries in 2022

The main New World wine countries all saw a fall in export volume except Australia, where volume rose 1.3%, and Canada where exports remained steady. However, the general rise in the price of bottled wine means most of these losses were offset somewhat by an increase in value.

Argentina saw the steepest drop with a 21% decrease in relative volume compared, but enjoyed a 7.4% rise in value. While wine exports from the US were down 14.7%, value increased by 11.8% to reach €1.4bn.

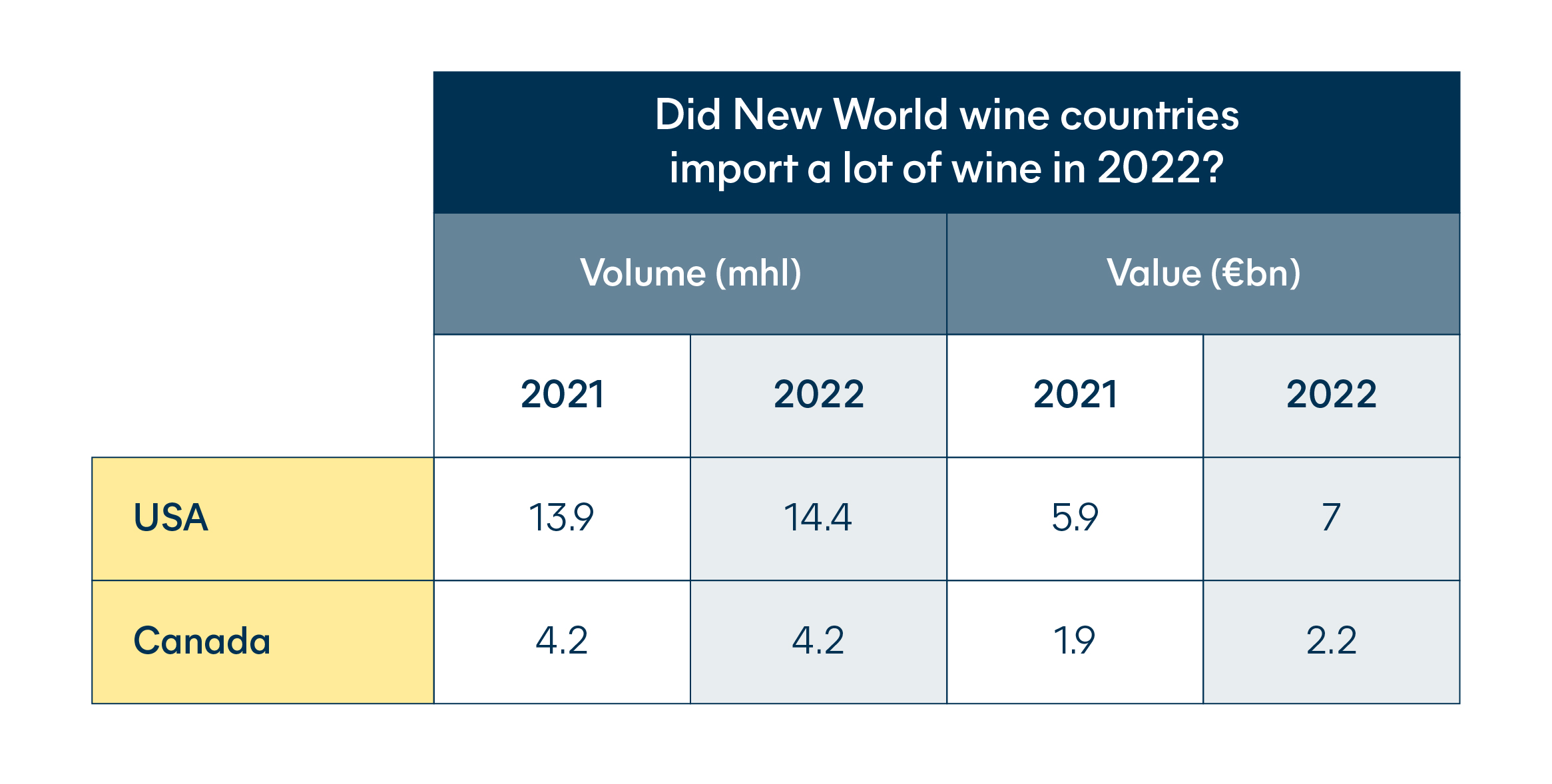

Did New World wine countries import a lot of wine in 2022?

Only the US and Canada make the top 10 when it comes to global wine imports. The US imported 14.4mhl, 3% more than 2021. Value totaled €7bn, an increase of 17%. This means the US remains the world’s largest wine importer by volume and by value.

While the 4.2mhl imported by Canada in 2022 equaled the volume for 2021 the €2.2bn spent represented a 14% rise in value.

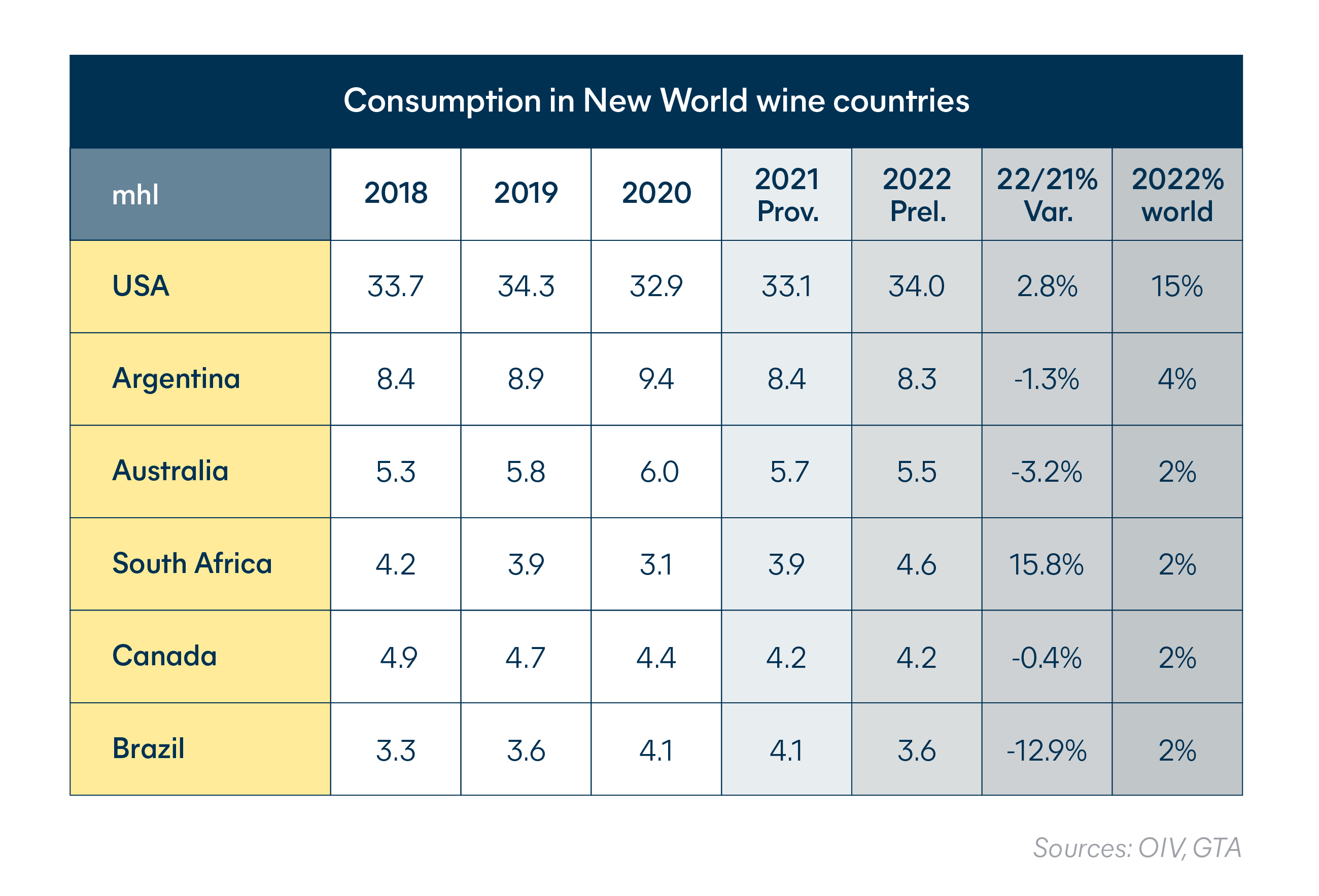

Consumption in New World wine countries

Not surprisingly, the world’s largest wine importer is also the largest consumer. Americans bought 34mhl of wine in 2022. This 2.8% increase on 2021 shows US consumption has recovered to levels recorded before the pandemic.

South Africans are also buying more wine. In fact, the 4.6mhl consumed in 2022 is a 16% increase and the highest level ever recorded in the country.

Consumption is down in Australia for the second year at 3% below 2021 and 2% below its five-year average. South America also saw falls in demand, including in Argentina, its largest market, with 1.3% less wine bought than in 2021. In Brazil, wine consumption reached record highs in 2020 and 2021, but 2022 saw a 12.9% drop to 3.6%. Although this marks a return to pre-pandemic levels.

Other developments of note in 2022

The sparkling wine success story

Globally, sparkling wine is the only category that increased both in terms of volume (+5%) and value (+18%). While it represented only 11% of global export volume, at an average export price of €7.7/l, it came second in value after still bottled wine and contributed 23% to the global total in 2022.

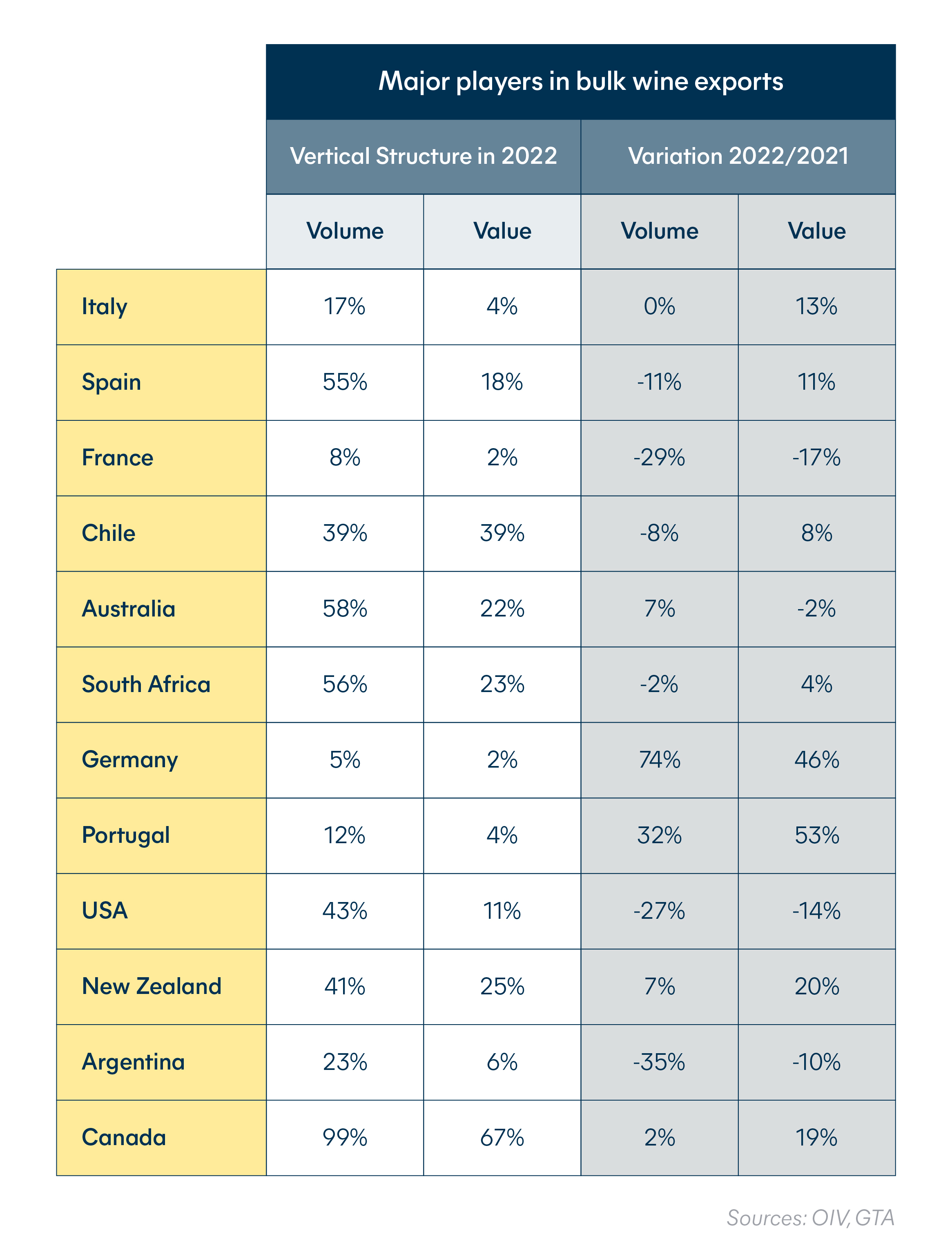

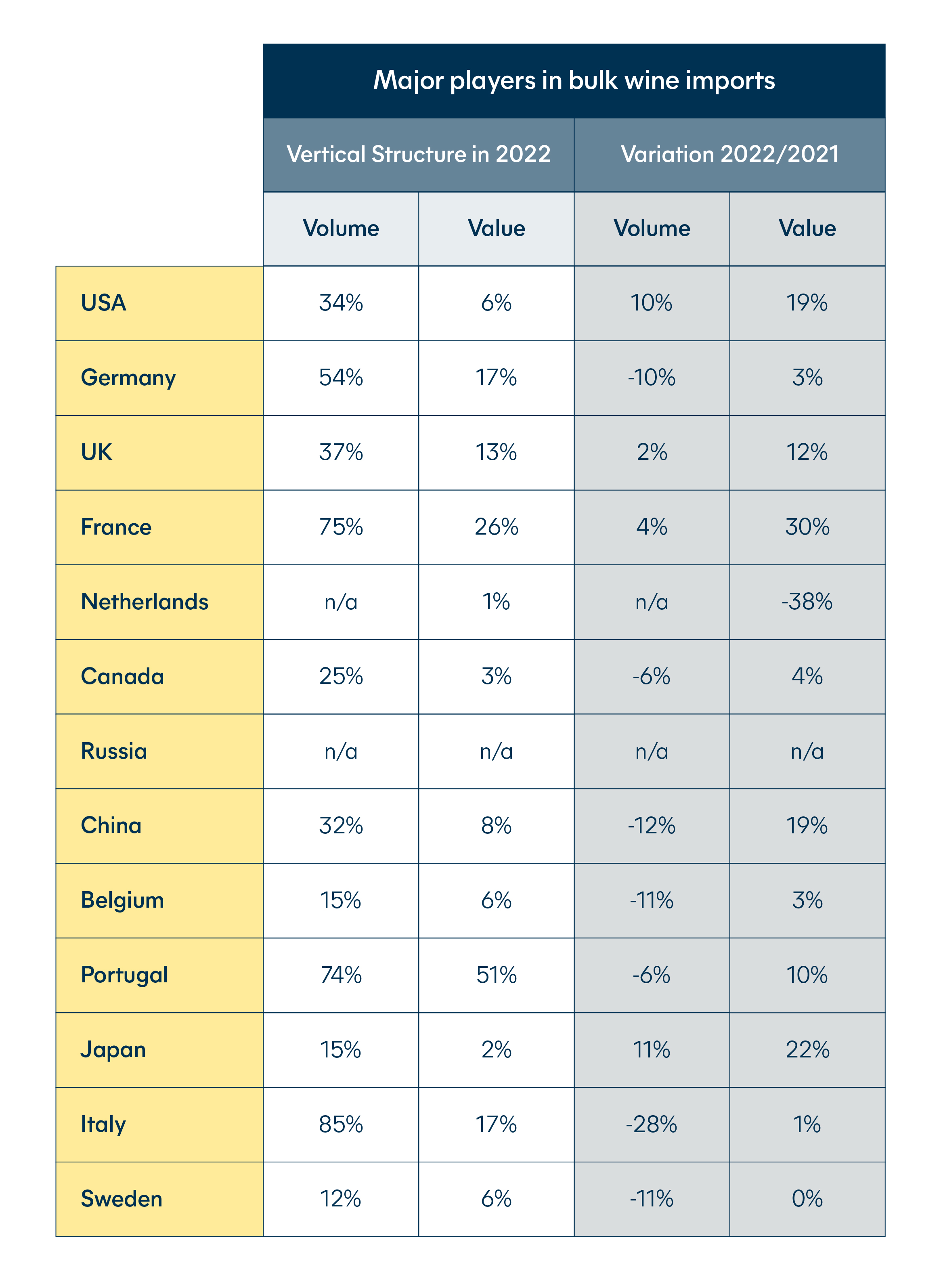

Major players in bulk wine import and export

Overall, bulk wine has a 33% share of total world exports and is the second-largest export category in volume. With an average export price of €78/hl in 2022, it only makes up 7% of the total value of wine exports, but that value is increasing. In 2022, bulk wine export volume was down by 7.2% compared to the previous year but value increased by 5.2% to exceed €2.67bn euros.

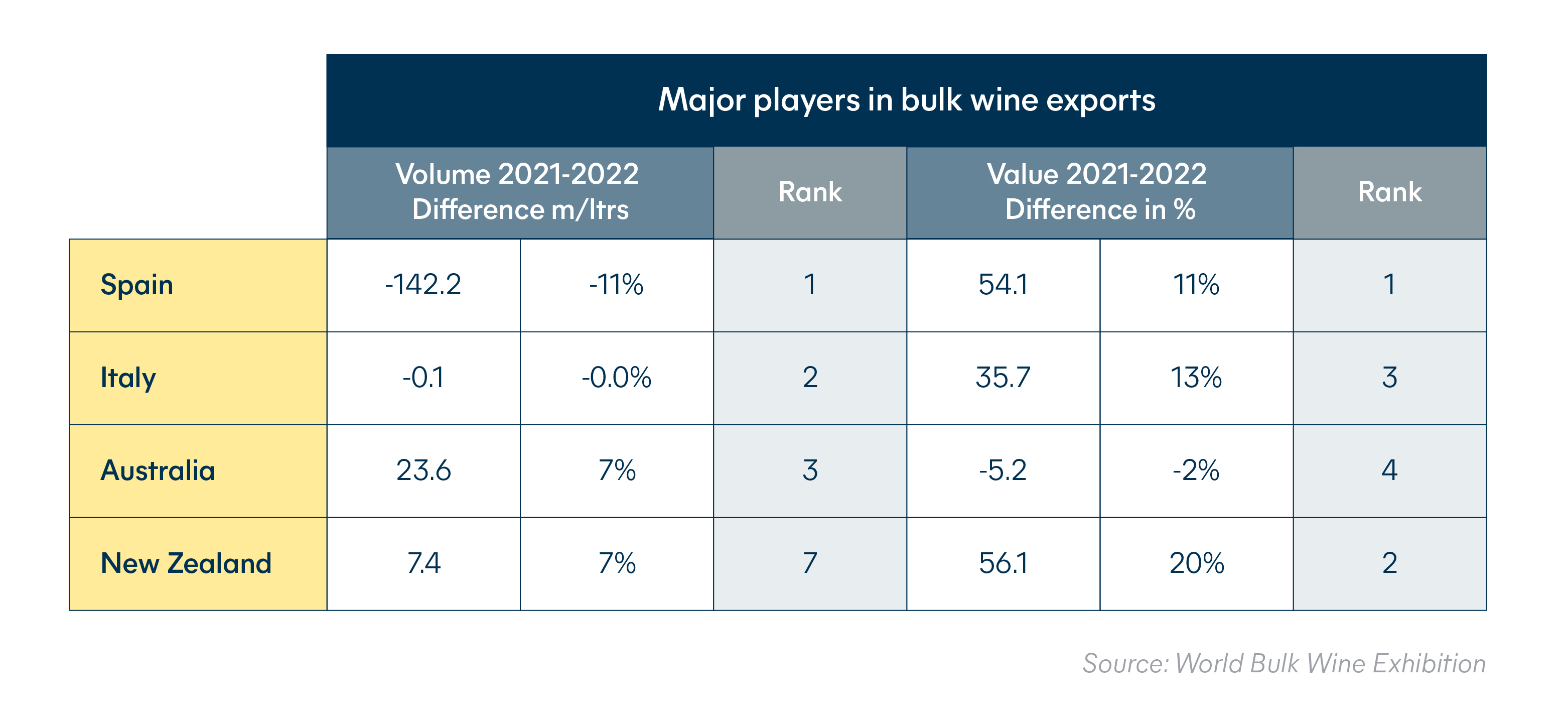

Spain, the number one supplier of bulk wine by value and volume saw an 11% increase in value offset an 11% drop in volume. Its €534m turnover was thanks to a 25% rise in the average price which reached €46/hl.

Italy maintains its position as the second biggest bulk exporter with a volume of 3.74mhl. Value went up by 13% to make €304m putting the country in third position globally.

On the other side of the world, while Australia’s 2.73mhl put it third in volume, the 7% increase couldn’t overcome a 2% drop in value.

In volume, New Zealand comes in seventh but 2022 saw it become the world's second-largest exporting country by value with a 20% increase netting it €340m. This is down to the much higher average price of €282/hl for New Zealand bulk wine exports compared to other big producers.

In terms of bulk wine imports, demand fell by 29% in Italy, although this category still accounts for 85% of Italian wine imports. Bulk made up 75% of French wine imports in 2022. Imports increased by 4% in volume and saw a 30% rise in value. Portugal imported 2.8mhl of wine in 2022, 74% of which was in bulk.

Emerging wine regions in 2022

Poor harvests, economic turbulence, and supply chain problems of recent years have led to higher prices and encouraged buyers to look further afield than usual for their wine imports.

Rather than relying on increasingly expensive traditional sources, importers are exploring more affordable wines from places like Jura, Beaujolais, or Savoy in France and Maremma or Franciacorta in Italy.

Good quality Greek, Portuguese, Hungarian, and Georgian wines are also undergoing a reappraisal thanks to their lower cost.

The emphasis on sustainability

Environmental issues and worries about sustainability are never far from your newsfeed. Indeed, wine producers themselves are on the front lines in dealing with the consequences of climate change across the world in the form of droughts, changing growing cycles, wildfires, and more. Consumers have started to express their own concerns by increasingly choosing wine sold in alternative packaging and buying more natural and minimal-intervention wines.

2022 trends in sustainably packaged wines

Glass bottles take a lot of energy to produce and transport and make up 29% of the carbon footprint of wine. They are also difficult to recycle compared to other packaging materials such as aluminum. Together, three 250ml aluminum cans hold as much wine as a typical bottle, but create 79% fewer carbon emissions. Though i think we are a long way from seeing Champagne on the shelf in a can!

Consumers interested in sustainability appear less shy about buying a non-premium wine in some non-traditional formats.

For example, the global canned wine market was estimated to have reached $518m in 2022. Canned wines, with their recyclable packaging, offer both a convenient and more sustainable way to consume wine. This up-and-coming category is predicted to be worth $1.4bn by 2032.

On the other hand, while bag-in-box (BiB) sales boomed during the pandemic, in 2022, numbers are down. BiB took 4% of volume and 2% of value of total world exports. At 376 million liters, this is the lowest figure since 2017 and represents a 4% drop in volume on 2021. However, with an 11% increase the average export price rose to €1.9/l increasing value by 6% to bring in a record high of €703m. That said, the market for this category is expected to grow from 2023 to 2030.

The rise of natural and minimal-intervention wines

The interest in natural and minimal-intervention wines can be summed up as a philosophy of “ minimal intervention to achieve the maximum natural purity”.

These wines are made mainly by independent artisan winemakers. Some common characteristics of natural and minimal-intervention wines include:

- Created with traditional methods

- Free from pesticides

- Natural fermentation using yeasts present on the grapes

- No or little added sulfites

- No filtering

- No added sugar

IWSR research found that consumers see natural wine as healthier, higher quality, tastier, and less harmful to the environment than traditional wine.

The research also found that the proportion of US and UK wine drinkers willing to pay a higher price for sustainable wine increased significantly between 2021 and 2022. In fact, 46% of US regular wine drinkers said, when given the choice, they would always choose a sustainable wine.

Worldwide, the related category of organic wines grew in volume by 5% between 2017 and 2022. Indeed, organic wine sales are growing in many markets where non-organic still wine sales are stagnant or falling such as the US and UK.

Distribution channels: direct-to-consumer, hospitality, tourism and wine clubs

Here are common distribution channels for wines:

- Direct-to-consumer sales

- Hospitality (e.g., restaurants, bars, hotels)

- Tourism (e.g., winery tours and tastings)

- Wine clubs and subscription services

- Retail stores

The distribution channels for wines are also evolving with the emergence of online marketplaces and e-commerce platforms. Many consumers now prefer to purchase wine directly from the producer or through online retailers, rather than traditional brick-and-mortar stores.

Industry experts predict this trend will continue, as more consumers become interested in natural and sustainable wines. In addition, wine clubs and subscription services have also become popular among consumers looking for a curated selection of natural wines delivered directly to their doorstep on a regular basis.

These services often offer discounts and exclusive access to limited-production wines, making them attractive to wine enthusiasts.

Let us help you with your wine shipments

Today's wine industry is a dynamic and complex environment, where both consumer tastes and global economic conditions are continually shifting. With the support of a freight forwarder specializing in beverage transport you will be better placed to successfully navigate every situation. Contact Hillebrand Gori, and let our experts help you make the right decisions for your wine imports.

Published 24th July 2023, updated 22nd May 2024

Reviewed by Hillebrand Gori

The wine industry refers to the production, distribution, and sale of wines. This includes everything from growing grapes to bottling and selling the finished product.

Industry experts projected that the global wine will grow from a total of $340.23 billion in 2021 to $456.76 billion in 2028. They calculate the compound annual growth rate (CAGR) from 2021 to 2028 to be 4.3%.

In 2023, wine production decreased by 9.6%, while consumption declined by 2.6% compared to 2022, according to the International Organisation of Vine and Wine (OIV). Despite a decline in global wine production and consumption in 2023, the balance between the two remains. Notably, with production outpacing consumption by 5% to 10%, this surplus facilitates additional applications, such as distillation and vinegar production.

Some major challenges facing the wine industry include climate change, changing consumer preferences, competition from other alcoholic beverages, and regulatory hurdles. For example, climate change has led to unpredictable weather patterns that can significantly impact grape production and quality. Additionally, consumers are becoming more health-conscious and seeking lower-calorie options or alternatives to wine. This has increased competition from other alcoholic beverages, like hard seltzers and ready-to-drink cocktails.

How can we help your business grow?

.png?sfvrsn=dc2a7a4d_4)

.png?sfvrsn=6e03ee20_1)